|

| Sasseur REIT |

Sponsor for Sasseur REIT is Sasseur Cayman, with Mr Vito Xu as the chairman for Sasseur Cayman and Sasseur Group.

Sasseur Cayman is a privately-owned outlet mall operator in China which counts L Catterton Asia Advisors (formerly L Capital Asia Advisors) and Pingan Real Estate as strategic shareholders. L Catterson is an affiliate of LVMH while Pingan Real Estate is a property giant managing about RMB 300 billion worth of asset.

Cornerstone Investor includes for Sasseur REIT includes:

1. Adroitt Ideology (Subsidiary of JD.com - China's e-commerce giant)

2. Bangkok Life Assurance Pcl.

3. CKK Holdings Pte Ltd (Charles & Keith)

4. Credit Suisse AG, Singapore Branch and Credit Suisse AG, Hong Kong Branch

5. DBS Bank Limited

6. Entrepolis Limited

7. Great Achievement & Success Pte Ltd

8. Haitong International Financial Products (Singapore)

9. TMB Asset Management Company Limited

The cornerstone tranche makes up about 45% of Sasseur total offering size and it also seems like there is quite a fair bit of support from some institution.

Taking a look at Sasseur Group on their official site, we will be able to find that they have 9 retail outlet properties spread out across China. However, in this IPO, we're only able to see 4 properties.

This in another word suggests to us that there are 5 other properties which constitute to roughly 64% of their Sasseur Group's overall NLA that have not been injected into this REIT. Should Sasseur decide to sell them to their REIT to realize the gains, we might be able to see some funds raising coming up. Alternatively, they may also tap onto some Ping An's property for third-party asset acquisition in the coming future and Sasseur seems to be eyeing on Xi'an and Guiyang's property to be next.

The other 5 retail outlets are as follow:

Sasseur (Xi'an) Outlets - 370,000 sqm (Under construction)

Sasseur (Zhongdong Changchun) Outlets - 370,000sqm

Sasseur (Nanjing) Art Commercial Plaza - 229,560 sqm, 95% leased

Sasseur (Hangzhou) Art Commercial Plaza - 45,873 sqm, 95% leased

Sasseur (Guiyang) Art Commercial Plaza - 260,000sqm (opened in 2017)

|

| Source: Sasseur REIT Prospectus - Page 24 |

Structure

|

| Source: Sasseur REIT Prospectus - Page 50 |

REIT manager: Sasseur Asset Management Pte Ltd

Nothing too much about the information below..

Management Fees: 10% per annum of distributable income

Performance Fees: 25% difference in DPU

2. What type of real estate do they hold?

Property type: Retail Outlet Mall

Total GFA: 374,603.3 sqft

Total NLA: 304,573.1 sqft

|

| Source: Sasseur Official Website - Sasseur Chongqing |

The 4 retail outlet malls in PRC are as follow:

1. Sasseur (Chongqing) Outlets

2. Sasseur (Bishan) Outlets - Situated in Chongqing too

3. Sasseur (Hefei) Outlets

4. Sasseur (Kunming) Outlets.

Information on properties can be found below:

|

| Source: Sasseur REIT Prospectus - Page 14 |

To start off, China imposes expiry on land use rights and only offer at most a 70-year lease for its residential properties, and typically shorter for commercial properties. From the table above, we will be able to identify that their average expiry of land use rights is about 37.5 year on average.

Due to this factor, their properties are in fact depreciating more than it could appreciate.

Even if there is appreciation in the real estate prices, this property lease or rather land expiry will actually cause the price of this property to fall back to square one. Hence, I do not think that organic growth will be really shiny here.

Similarly, from the table, we will also be able to spot that Sasseur REIT has an average occupancy rate at 95.1%, the occupancy rate might seem high but I do have something in the later part which is tickling me a little.

Across the 4 properties, Sasseur REIT has:

Total GFA: 371,603.3 sqm

Total NLA: 304,573.1 sqm

Yes, this is about 20% of their area across this 4 properties are not leasable

Sasseur REIT's tenant spread across multiple industries , from cinema operators to F&B outlets with quite a few luxury goods tenant like Gucci, Hugo Boss, Salvatore Ferragamo etc.

3. WALE:

The IPO portfolio has a WALE of 3.2 years based on NLA.

This is relatively low as compared to its peers like CRCT and BHG Retail REIT.

|

| Source: Sasseur REIT Prospectus - Page 16 |

|

| Source: Sasseur REIT Prospectus - Page 41 |

Maybe not so much after I see this, I thought to myself.

And there is about 90% of Sasseur's tenant that is subscribing to this method of leases!

Looking at the bright side, tenants might not mind staying on their premises when the market is bad or that they do not have many customers. This is simply because I do not need to pay a fixed rent every month! This approach, on the other hand, secures your tenant, in a pretty weak way.

But on the other hand, this will also mean that my dividends received will be swinging accordingly to their sales! At times when there are great sales, I will be receiving some handsome DPU, similarly, I might not receive a single penny when they do not sell anything!

4. Net Asset Value (NAV)

I will also need a greater margin of safety if I were to invest in this piece of business with the amount of risk I'm presented to feel comfortable. Hence, what's in it's NAV column, we will have to be seeing a lower number than it's price.

With the total net asset at around $921.277 million and post offering at 1,180,300,000 units, this will be somewhere around 78 cents for each share.

An indicative offering price range around 0.80 - now this price translates to a slight premium over Sasseur's NAV. In that case, probably not for me.

(Please refer to unaudited pro forma financial statement below in point 5)

5. Gearing

|

| Source: Sasseur REIT Prospectus - Page 163 |

This is a really decent set of gearing I'm seeing here at 30.3% which is relatively low. In some other sense, there is plenty of room for them to take up debts to fund their upcoming acquisitions.

However, taking a slightly closer look at their unaudited pro forma financial statement, I'm looking at something that is slightly different.

|

| Source: Sasseur REIT Prospectus - Page 155 |

6. Dividend Yield

|

| Source: Sasseur REIT Prospectus - Page 66 |

First distribution is expected to come in on 30/09/18 for the period ended 30/06/18

Sasseur REIT will be distributing 100% distributable income up to 31/12/19.

Sasseur promises a 7% yield in 2018 and mid 7% in 2019. However, I'm not comfortable with this number I'm seeing here.

For the risk I'm facing for this investment, I will demand a greater dividend yield as compared to Sasseur's peer like BHG Retail REIT and CapitaRetail China Trust to compensate of the risk.

But wait. There's already one risk about its DPU due to its business structure discussed earlier.

For a greater risk, I demand a greater reward!!

7. When will their IPO take place?

Singapore Public Offer: 22 – 26 March 2018

Expected listing on the SGX-ST: 28 March 2018, 9am

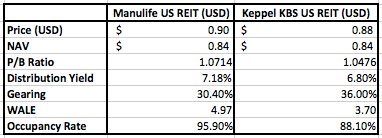

8. Peer Comparison

The 2 closest peer I can find from SGX would be CapitaRetail China Trust and BHG Retail REIT and I've done up a simple table for some basic comparison. However, do note that despite they are retail properties in PRC, they differ a little as Sasseur operates slightly differently.

|

| Peer Comparison |

Risk:

1. Currency Fluctuation Risk (SGD-RMB)

As shared in my 2 earlier REIT IPO Analysis on Cromwell and Keppel KBS REIT, earnings for Sasseur is also in a foreign-dominated currency. And in this case, we are looking at RMB, this exposes us to currency fluctuation risk. Which will mean that if RMB depreciate against SGD, we will see a less significant distribution?

2. Business Model Risk

As Sasseur REIT is very heavily dependent on its tenant's performance, this will come into the picture as a double edge sword. This is due to sales driven income by property which calculates rental by turn over as opposed to fixed income. In another word, inconsistent dividends, and I'm not a big fan of this.

3. Geographical Concentration Risk and Property Expiry

For those looking for exposure to owning some assets in China, Sasseur REIT might be one REIT that you can dip your toes into. Aside from this, we have BHG Retail REIT, MGCCT, CapitaRetail China Trust. Once again, being a property in China, which is subjected to property expiry rules, this is not a very cool thing and will limit organic NAV growth.

All 4 properties of Sasseur or in fact, all properties that Sasseur Group holds are in PRC. This will provide you with geographical concentration risk. Should China market face some headwind, this investment will go together with the flow.

I might be wrong, and I hold no crystal ball but having that said, I'm not exactly comfortable with the risk that I'm seeing here and I'll be giving this IPO a miss.

IPO prospectus can be found here.

Sasseur's ST news can be found here.

CRCT 4QFY2017 financial presentation can be found here.

BHG Retail REIT 4QFY2017 financial presentation can be found here.

Read:

REIT IPO - Keppel-KBS US REIT

Edited: 25/03/2018 1:14PM :

There have been a great number of financial bloggers covering the IPO analysis on Sasseur REIT and I would advise that readers take a look at their comprehensive and wonderful analysis as well to get a better understanding of Sasseur REIT.

Please find the link below:

ProButterfly - Qualitative Analysis of Upcoming Sasseur REIT IPO

B, Forever Financial Freedom - Sasseur REIT IPO Analysis

SG Budget Babe - IPO Analysis : Sasseur REIT

Mr IPO - Sassuer REIT

Financial Horse - Sasseur REIT: Why I am so disappointed by this 7.5% yielding China REIT

Kyith, Investment Moat - Sasseur REIT – My Short Take on this Messy China Retail Outlet REIT

SmallCapAsia - 7 Things You should Know About Sasseur REIT IPO

TheFifthPerson - Sasseur REIT IPO – 5 key things you need to know before you invest

Reitit - Quick Analysis on Sasseur REIT