Recalling back, the last time I officially wrote something about CDG is back in December 2017 regarding the alliance with Uber.

| Source: ComfortDelGro |

|

| Source: Google - CDG's Share Price |

The title of this blog post may sound really misleading but I'm sure that some readers would probably guess it right from reading the title.

I'm not lying!

Feeling bored from work some days ago, I've also decided to a do a simple TA on ComfortDelGro to understand a little bit more about the recent price actions.

To cut things short, I've decided to reduce my exposure with CDG and sold 600 shares of ComfortDelGro at 2.38 in the market today.

To simplify it, with an average price at $2.07 per share, I'm looking at a profit of 37.5 cents per share (including dividends), which will translate to $262.50

Along with the dividends received, I've sold 600 units in the market today, taking back the first dollars I've injected into CDG. Thus, making the 100 units in balance free-of-charge.

For the slightly mathematical person, based on the closed positions, I'm looking at a gain of +15.5% from this divestment or an annualized return of 23.4%.

Who doesn't like free thing!?

Personally, I'm a cheapskate and enjoy free things.

This time round, I'm enjoying some free shares from ComfortDelGro.

I'm sure things will look much better if I have a higher vested interest/capital to deploy for CDG. Not forgetting if I have a lower average price or that I've bought more when it's hovering around 1.90.

In this episode, I've also learned that market timing and account size is very important too!

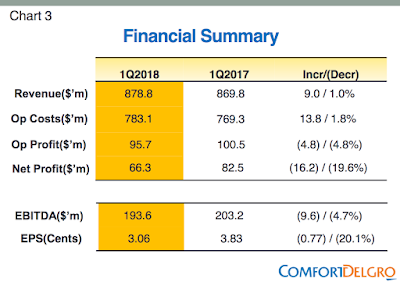

A very brief and quick look into CDG's 1Q18 Financial Results

CDG has also released it's 1Q result last Friday which have posted a slightly better outlook as compared to the latest result.

|

| Source: CDG 1Q18 Financial Presentation - Slide 3 |

With the improving sentiments in the local taxi business and foreign acquisitions, this might be an avenue where CDG will be able to bring their EPS up and back, which might bring smiles onto the faces of investors.

With this in mind, assuming that all 4 quarters EPS is to remain at 3.06 cents, this will bring me to earnings of 12.24 cents. Taking the price at 2.30 into consideration, we're looking at a P/E ratio of 18.79 which is no longer cheap in my opinion.

It's not exactly accurate to measure the earnings in this manner as they're subjected to its upcoming business performance. However, only with greater earnings to come, this will make CDG at this price today a cheap business to own.

Comparing to its P/E ratio today to months ago and days during a crisis, CDG is no longer a cheap company to own and I'm definitely not looking to buy into CDG at this price.

|

| Source: CDG 1Q18 Financial Presentation - Slide 7 |

|

| Source: CDG 1Q18 Financial Presentation - Slide 21 |

I'm thankful and felt that I've been lucky as an investor of CDG to receive some freebies from them. But as a novice, I must remember to not be greedy as greed is the root of all evil.

Having to divest partially from CDG, I honestly felt that there is still room for CDG to improve on as a company despite facing headwinds in the local taxi businesses, although Uber's departure would probably subdue a little effect in it.

CDG have been looking for opportunities to invest into the foreign market such as the recent acquisition of Dial-A-Cab in UK and Tullermarine Bus Line in Melbourne to diversify their earnings beyond the reliance on taxi business in Singapore. CDG is also trying to hook up with Go-Jek, an Indonesian ride-hailing company as CDG's ride-hailing partner in Singapore.

In the latest news, CDG has also added 200 new Hyundai Ioniqs to its fleet to accommodate more returning drivers from the PHV business. This addition of fleet has not happened since the last 1.5 years.

All these events on top, if lucrative will also provide CDG with a greater earning and revenue to come.

With these paying off, I'm sure CDG will be recovering from the damages sustained in the last technology disruption. Not saying that the technology disruption has ended, but for now, the effect is lesser as compared to the days in a triple threat match. Nonetheless, Grab today still pose itself as a competitor against ComfortDelGro and I will not be surprised to see more news and attempts from Grab to battle CDG once again.

As such, I've decided to be a contented investor of CDG and keep this 100 free shares from them.

I'm a little sad today to say goodbye to its future outlook and the number of free burgers that I'll be possibly receiving from them annually.

But on the other hand, I'm glad that this 100 free shares will translate to 2 free Fillet-O-Fish meal each year for me.

So it this considered as a compounding free gift!?

CDG's 1Q18 Financial Presentation can be found here.

CDG's 1Q18 Financial Statement can be found here.

Read:

Accumulating ComfortDelGro

Portfolio Update - ComfortDelGro & Wilmar

You may also subscribe to receive my latest email updates here.

With larger account size in the future; these freehold shares method to collect passive income works fine across market cycles.

ReplyDeleteHi Uncle CW,

DeleteI still believe in account size that matters alot. A little element of luck will boost the play. For now, I’m lucky and hope that these lessons will turn out to be educational in my upcoming route.

I agree with you. And I do enjoy the passive income works from freehold shares. Hopefully in the future, I’d be able to learn more from Mr Market and wise seniors like you along the way ;)

sillyinvestor,

ReplyDeleteYou made $262.50 (50 cents is counted too!) in your pocket.

Your entry and exit (including dividends) return is 15.5% ;)

You may want to reflct why you included the "annualised return" of 23.4% ???

Thankfully, your "sugar-coating" has not distracted you to your epiphany that account size matters ;)

Alamak.. Jared. I became sillyinvestor again.

DeleteIf only I’m sillyinvestor, I’d be glad and jumping around.

For now, I can only admire from far.

50 cents plays a part too in pico sized portfolio like mine. Hence must put inside to appetize it more.

As I’ve held CDG for less than a year, I cheated and added a little sugar coat to make me feel a little better.

But deep down, in numbers. I know the fact!!

I’m really lucky in this episode and I view it today, as an important lesson or experience (I have for now) in the market.

Hopefully, in the future. This lessons will pen out well.

Sleepydevil,

DeleteA thousand apologies!

Lucky sillyinvestor is married.

And I'm not into men ;)