While I'm still relatively young as compared to majority of the peers around, this does not indicate that we are different.

Age is just an indicative number that tells us how long we're around on planet earth. What's more important is our mentality towards dealing with issues that cropped up in our lives.

We are all humans. And having to mention about this, I vividly remember one of my favourite sentence in AK's blog.

|

| Source: AK71 |

Much contradicting to my statement above, but we should take a look at the key in this statement - We must know ourselves.

Hence, I felt that irregardless of age, we are not different and we have to know ourselves.

As we live longer on this planet, we've obtained something in return for our time - Experience and Wisdom.

I've been very busy lately which explained the reduce in blog post over this couple of months. Nonetheless, I still have many drafts awaiting for my to write on and publish.

Hence, to the regular readers who is looking forward to my post, I deeply apologize for it and please pardon me for that.

As this is a birthday post, I shall do a brief review for the my 19th Year of planet earth:

1. Finances

In my 19th year on this planet, I've embarked on this financial route. I started reading extensively on the topic of finances. I've also started to pen down my thoughts, learnings and route in this small little area here, despite having a poor command of English.

Personally, I'm not born in with a golden or silver spoon. Or rather, I should be. But that spoon happen to went to another side of the family 2 generations ago.

By a twist of fate, I ended up with a plastic spoon. But, I do not blame the fact that the spoon fell off and in fact, I embrace that situation.

Coming to it, as a single-parent student that is born in a plastic spoon. This has taught me many valuable lessons in life and finances.

Having this situation above, I'm unable to make significant contribution to my wealth building pot, but I know this deep down that this shouldn't be one thing that is stopping me from taking up this financial path.

Looking back, when I first set foot onto this journey. I've made a plan to allocate $15 into my portfolio each day, to a sum of $15 x 365 = $5,475.

Read: My First Post

After 10 months of hardwork, the plan materialize with a small help from the market and a huge contributing factor to it would be the income I receive from my part time job to finance this goal.

This allowed me to understand that your Primary Income is a big supporting factor and a push for you to finance your goals towards financial freedom.

Read: My First Pico Milestone - Conquered

I've made some adjustment then and have decided to go with a target of $7,000 by the end of 2017. As a lonely guy in Japan back then, I've decided to start with some trading and selected the cryptocurrency market to be my tool.

I do not know anything about TA prior. As I'm not a smart guy, I took a couple of months to understand it. Sadly to say, even till today, I'm not proficient in TA either.

I got lucky, and my wish once again came true with the help from my cryptocurrency adventures.

Now, in this episode, I understand that In order to achieve our goals, a plan is required. A big pushing force would be your luck.

Read: Portfolio - December 2017

Just before 2017 ends, I've made plans to obtain my first 5 digits in my portfolio before 1H2018, which is just before my birthday.

Once again, with the help of the bull market and the injection from my meagre income. Today, I'm glad to once again announce that I've achieved my 3rd goal I've set ever since I embark onto this journey.

The amount is little and insignificant to many around. But this lesson to me is indeed remarking. I've also made several adjustment to my portfolio this month and I'll soon be giving an update about it in my Portfolio Update for May 2018.

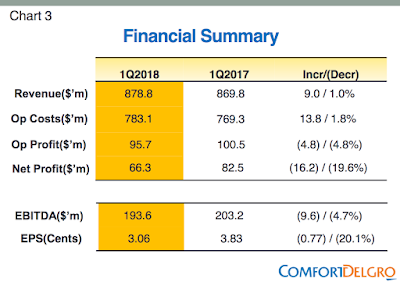

In the process of obtaining my first 5 digits, one of my adventures with CDG has allowed me to further understand the bigger concept behind Account Size and Market Timing.

Read: Free Shares from CDG

There's still many lessons awaiting me ahead. All I could do is to get myself geared up and be prepared to learn.

There is a great number of people who are extremely curious about my transaction cost and how silly I am to take a huge shave off my gains from these expenses due to my peanut-sized portfolio and holdings.

Today, I'd also like to take this as an opportunity to share some of my thoughts about it.

This is an adventure taken by me to achieve financial freedom. And being educated is a part of it.

One can always not start if they feel that they're uncomfortable with fees being paid. Afterall, investing is not the only way towards achieving financial freedom.

There is many ways available. It's important to find out the way that is most suitable for you.

2. Personal

I'm glad that things are starting to fall into places after some plannings made a year ago. Probably this is telling me that my hardwork is starting to get paid off? However, I guess I'm still a silly guy afterall.

I've missed out on many things.

I will not jump in too much on this area. But I guess I will have to learn more about things around me and how to better optimize myself.

In this year I manage to understand myself better and differentiate things better.

Sometimes, theory lessons are really simple and easily understood. But practically, it becomes a big problem for us.

To keep things short, there are 2 different things around us.

1. The Controllable

2. The Uncontrollable

If we are always thinking about the uncontrollable factors affecting us. We will soon be affected by things that are controllable.

Exercising self discipline and controlling factors that are controllable is what human should be doing. But it seem that sometime, our heart takes a better lead.

I guess.. I shall not continue too much about this here. And today, I shall be a sleepy devil. A true sleepy one.

Good night.